LIXIL makes pioneering water and housing products that solve everyday, real-life challenges, making better homes a reality for everyone, everywhere.

- Global Site

-

- English

- Japanese

- Brand Sites

Global

- Global Site

-

- English

- Japanese

- Brand Sites

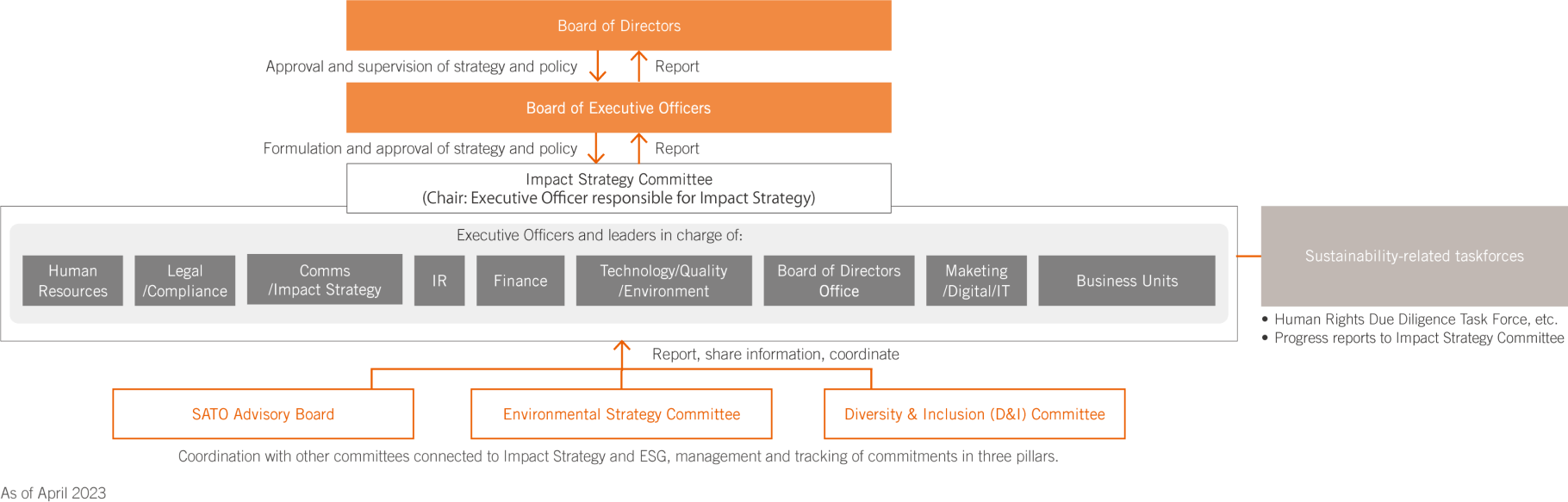

LIXIL holds quarterly Impact Strategy Committee meetings to take a strategic approach in solving sustainability issues material to our business and key stakeholders.

The Impact Strategy Committee comprises executive officers and senior managers from corporate functions and our business divisions to ensure timely and appropriate strategic actions across LIXIL. The executive chairperson of the Impact Strategy Committee reports the results of committee discussions and deliberations to the Board of Executive Officers on a quarterly basis, enabling any necessary decisions to be made. The Board of Directors also receives biannual progress reports for further discussion and oversight.

The outcomes and resolutions made by the Impact Strategy Committee are communicated to corporate and business functions by the responsible executive officers and senior managers, accountable for the implementation of specific initiatives. There is also a periodical exchange of information between the Impact Strategy Committee and other committees involved in the execution of these activities.

The Global Sanitation & Hygiene Council, the Environmental Strategy Council, and the Diversity & Inclusion (D&I) Council report progress updates on initiatives aligned with the Three Strategic Pillars at each meeting of the Impact Strategy Committee. The Committee also engages in strategic discussions on other environmental, social and governance (ESG) topics.

FYE2024 Key Agenda Items:

- Governance of the Impact Strategy Committee

- Plan to review LIXIL’s material issues

- Approaches to key disclosure frameworks, such as CSRD and ISSB

- Human rights initiatives

- Enhancing ESG data governance