LIXIL makes pioneering water and housing products that solve everyday, real-life challenges, making better homes a reality for everyone, everywhere.

- Global Site

-

- English

- Japanese

- Brand Sites

Global

- Global Site

-

- English

- Japanese

- Brand Sites

Board of Directors

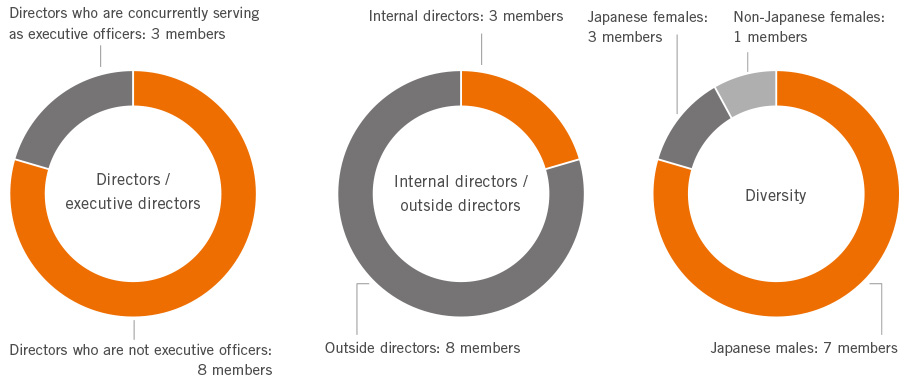

The Board of Directors consists of ten directors, including eight outside directors with four female director. The Board decides on matters stipulated by laws and regulations, basic management policy, and other important management matters. At the same time, the Board supervises the execution of duties by the directors and executive officers. Outside directors in particular perform an important supervisory role from an independent standpoint, helping to ensure even more robust and effective corporate governance. The Board selects the Chief Executive Officer (CEO) and other Executive Officers placing emphasis on whether the Company can continue to realize its management vision and policy in the years ahead. In principle, the Board of Directors meets once a month.

Composition of the Board of Directors (10 members as of June 2024)

Composition and operation of Nomination Committee, Audit Committee, and Compensation Committee, etc.

LIXIL adopts the following structure so that the Nomination Committee, Audit Committee, and Compensation Committee are able to effectively fulfill their role and duties as required by law, in addition to enabling the Governance Committee to effectively fulfill its responsibility and role of monitoring and supervising corporate governance across each committee.

(1) The majority of the members of each committee shall all be independent outside directors who satisfy LIXIL’s independence criteria.

(2) The chairperson of the Board of Directors and the chairperson of each committee who also chairs its meetings shall be an independent outside director.

The deliberation details and resolution matters of each committee are reported by the chairperson of the committee at the Board of Directors Meeting held immediately after the committee meeting.

The Nomination Committee is made up of four outside directors. This Committee decides the details of proposals submitted to the Annual Shareholders’ Meeting concerning the appointment and dismissal of directors. Also, the Nomination Committee will report its opinion to the Board of Directors such as on the appointment, election, removal and dismissal of candidates for executive officers and representative executive officer (Chief Executive Officer), etc., requested by the Board of Directors. The Nomination Committee meets at least once a year.

The Audit Committee is made up of five outside directors. In addition to auditing the execution of duties by the directors and executive officers, the Audit Committee decides the details of the Company’s audit policy, audit plans, proposals for the appointment or dismissal of the independent auditors the Annual Shareholders’ Meeting, and other matters. As a rule, the Audit Committee meets once every two months or more.

The Compensation Committee, composed solely of outside directors, determines compensation policy for directors and executive officers received from the Company as consideration for their duties and the individual compensation for them.

Composition of the Board of Directors and Committees and Position of the Chairperson

| Number of members | Internal directors | Outside directors | Chairperson (of the committee) | |

|---|---|---|---|---|

| Board of Directors | 10 | 2 | 8 (8 are independent directors) | Outside Director |

| Nomination Committee | 4 | 0 | 4 (4 are independent directors) | Outside Director |

| Audit Committee | 5 | 0 | 5 (5 are independent directors) | Outside Director |

| Compensation Committee | 4 | 0 | 4 (4 are independent directors) | Outside Director |

Governance Committee

The Governance Committee shall be composed of only independent outside directors, with the objective of the company’s corporate governance continued enhancement, discusses or advises the Board of Directors on matters such as reviewing and amending the Group’s Corporate Governance General Policy and playing the lead role in carrying out the evaluation of the effectiveness of the Board of Directors. The Governance Committee, in cooperation with the three committees required by statute (the Nomination Committee, the Audit Committee and the Compensation Committee), strives to establish and improve the Group’s corporate governance system. The Governance Committee meets at least once a quarter. The improvements of the corporate governance system will be reported to shareholders, investors and other stakeholders through disclosed documents such as the Securities Reports and Corporate Governance Reports.

Audit Framework with Audit & Supervisory Board Member

To enhance the system that supports the Group’s Audit Committee and strengthen the internal

control of the Group, “Audit & Supervisory Board Members under LIXIL Audit Framework” are distributed to

domestic major subsidiaries to exclusively conduct audits of the subsidiaries, enhance the effectiveness of

the subsidiaries’ audit activities, and aim to strengthen corporate governance.

The Group’s Audit

& Supervisory Board Member under LIXIL Audit Framework is composed of an appropriate number of persons

(no more than 5 persons) and periodically conduct meetings with the Audit Committee and report on the

implementation status of audits through the Audit Committee Secretariat.

Board of Executive Officers

The Board of Executive Officers is made up of the executive officers and serves as a decision-making body for business execution based on the basic policy decided by the Board of Directors. It decides on important matters relating to business execution of the Company. In principle, the Board of Executive Officers meet once a month, and extraordinary meetings are held as necessary.

Internal Audits

At LIXIL, Corporate Audit (the Internal Audit Group) supervises internal audit functions in Japan and overseas, covering all group entities worldwide.

In addition to performing standard internal audits, including accounting audits, business audits and internal control assessment, Corporate Audit also continuously reviews LIXIL’s internal audit system and processes to help the group as a whole achieve sustainable growth, as well as strengthen governance, internal controls and human resource development.

Audit Committee Audits

LIXIL's Audit Committee conducts audits with the aim of increasing efficiency by staying in close contact with the Internal Audit Group of LIXIL and subsidiaries, and the Audit & Supervisory Board Members under LIXIL Audit Framework. The Audit Committee periodically receives audit results reports from the Internal Audit Group and the Audit & Supervisory Board Members under LIXIL Audit Framework and gives instructions at suitable times. It conducts interviews with executive officers, etc., sits in on important internal meetings, and reads minutes or approval requests of important committees, and by doing so, it audits the creation of internal control systems and their state of operation at the Company and important subsidiaries, as well as the state of execution of duties by directors and executives. The Audit & Supervisory Board Members under LIXIL Audit Framework also meet periodically to share each company's information and the unified audit policies of the group.

Accounting Audits

The Company has concluded, with Deloitte Touche Tohmatsu LLC, an audit agreement on audits under the Companies Act and audits under the Financial Instruments and Exchange Act. The Company's Audit Committee and Deloitte Touche Tohmatsu LLC have opportunities to share information periodically, and are endeavoring to improve the quality of each other's audits by such means as exchanging information on their respective auditing policies and various problems that have arisen during the period. Also, an audit debriefing session is held at the end of the fiscal year, where opinions are exchanged with respect to account settlement issues in concrete terms.

The name of the certified public accountants who performed the Company’s auditing work in the fiscal year ended in March 2024, and their structure of assistants for audit services are as follows;

・Name of certified public accountants who performed the auditing work Designated limited liability partners, managing members: Taiji Suzuki, Takenao Ohashi, Masayuki Furukawa

・Composition of assistants for accounting audit services:

32 certified public

accountants and 55 others

Other Committees

In order to enhance corporate governance at its group companies, the Company established the Governance Committee within the Board of Directors as a discretionary committee, and also appropriately holds executive side meetings such as Investment Review Committee, Risk Management Committee, Impact Strategy Committee, and Compliance Committee, and discusses management strategies, medium- and long-term policies, investment matters, etc. to strive to accelerate decision-making and enhance the effectiveness of its governance.

Reasons for Adoption of Current Corporate Governance System

The Company changed to the Company with Committees, currently the Company with Nomination Committee, etc., after obtaining resolution at the shareholders’ meeting held on June 23, 2011, in order to separate its managerial execution and supervisory functions to enable prompt decision-making by executive officers, and to secure transparency of its business.

Number of meetings held during FYE2024

| Board of Directors | 15 | Made decisions on matters specified by law, basic management policies, and important management matters, while deliberating on medium- to long-term growth strategies and strategies to improve corporate value. In addition, oversaw the conduct of duties of directors and executive officers. |

| Nomination Committee | 13 | Made decisions on the content of proposals to be submitted to the Shareholders’ Meeting regarding the election and removal of directors. Reported its opinion to the Board of Directors after due consideration and deliberation, such as on the election, appointment, removal, and dismissal of candidates for executive officer, executive officer with responsibility, and Representative Executive Officer, and on the appointment and dismissal of the Chairperson of the Board, members, and chairpersons of each committee. |

| Audit Committee | 14 | In addition to auditing the conduct of duties by directors and executive officers, discussed and made decisions on auditing policy, auditing plans, and the content of proposals to be submitted to the Shareholders’ Meeting regarding the election and removal of financial auditors. |

| Compensation Committee | 14 | Made decisions regarding the compensation of directors and executive officers and their individual compensation received from the Company as consideration for duties. |

| Governance Committee | 8 | Continually enhances the Company’s corporate governance, discusses or advises the Board of Directors on matters such as reviewing and amending the LIXIL Corporate Governance General Policy, and manages the implementation of the evaluation of the effectiveness of the Board of Directors. |

| Board of Executive Officers | 15 | As the decision-making body responsible for the execution of business activities in accordance with the basic policies approved by the Board of Directors, this Board decided on important matters relating to the execution of business in the Company and the LIXIL group of companies as a whole. |

| Investment Review Committee*1 | 27 | Deliberated and made decisions on material investments (excluding those relating to M&A), financing, and matters relating to the establishment, reorganization, and restructuring of subsidiaries (conducted by the Company and its subsidiaries) within the authority delegated by the Board of Executive Officers. |

| M&A Committee*2 | 24 | Deliberated and made decisions on matters relating to M&A (including divestment of business) conducted by the Company and its subsidiaries, within the authority delegated by the Board of Executive Officers. |

| Risk Management Committee | 1 | Deliberated on uncertain events (risks) that could present opportunities or threats to the achievement of our business objectives, considered the need for measures and formulated response strategies, and also reported on company-wide risk management to the Board of Directors and the Board of Executive Officers. |

| Impact Strategy Committee | 4 | Coordinated the advancement of LIXIL's sustainability commitments by overseeing the execution of priority initiatives and ensuring the development, alignment and achievement of goals within the Impact Strategy. The Committee also led the management of LIXIL's material issues and maintained robust communication with the Board of Directors, the Board of Executive Officers and relevant councils. |

| SATO Advisory Board*3 | 4 | Reviewed and provided guidance on SATO’s overall business strategy and key operational issues such as annual targets and strategic plans, internal and external partnerships, and risk management. The SATO Advisory Board was dissolved at the end of FYE2024. A new governance structure was put in place, with business review occurring under LIXIL's business governance, and the impact progress and other LIXIL initiatives happening in this area reported through the Global Sanitation & Hygiene Council. |

| Environmental Strategy Committee*4 | 4 | Established and implemented environmental strategies, including the formulation of regulations and policies related to environmental governance, deliberation and decision-making on measures to address environment-related issues, and management and monitoring of group-wide environmental targets. |

| Diversity & Inclusion Committee*5 | 1 | Supervised formulation and implementation of basic diversity and inclusion policies and roadmaps throughout the LIXIL group of companies. |

| Compliance Committee | 4 | Resolved the important compliance strategy and plans as well as reported on training and promotional activities of the LIXIL group of companies. |

| Compensation and Benefits Committee | 6 | Made decisions regarding compensation and benefits structures for officers as well as employees of the Company and the LIXIL group of companies and officers’ individual compensation, except for the matters to be exclusively resolved by the Compensation Committee, while monitoring HR policies in terms of compensation and benefits. |

| Information Security Committee | 4 | As the committee responsible for decision-making on fundamental matters related to group-wide information security and data privacy, decided on and approved relevant policies, resolved issues, approved implementation of countermeasures, and conducted measures to ensure awareness. |

| Group Credit Committee*2 | 5 | Resolved and deliberated on credit management related to business transactions with third parties conducted by the Company and its subsidiaries in order to accelerate decision-making and enhance effectiveness of governance. |

| Stock Sale and Purchase Review Committee | 6 | Conducted reviews and examined insider trading regulations in order to prevent rule violations as well as to fulfill the Company’s social responsibilities as a business in the event that officers or employees give prior notification they will be engaging in the sale or purchase of the Company’s shares and others. |

*1 As of April 2024, the functions of the M&A Committee and the Group Credit Committee have been consolidated.

*2 As of April 2024, merged into the Investment Review Committee.

*3 Currently the Global Sanitation & Hygiene Council.

*4 Currently the Environmental Strategy Council.

*5 Currently the Diversity & Inclusion Council.

About Us

- About Us

- Our Purpose and Behaviors

- Value Creation Process

- Corporate Governance

- Our Brands

- Corporate Information

- Our History

- Group Companies

- Board & Executive Officers

- Kinya Seto

- Jin Song Montesano

- Jun Aoki

- Shigeki Ishizuka

- Ryusuke Ohori

- Shiho Konno

- Mayumi Tamura

- Yuji Nishiura

- Daisuke Hamaguchi

- Mariko Watahiki

- Yugo Kanazawa

- Bijoy Mohan

- Satoshi Yoshida

- Hiroyuki Oonishi

- Shoko Kimijima

- Mariko Fujita

- Reason for Nomination and Expected Role of Directors

- Reason for Election of Executive Officers

- External Evaluations & Awards

- LIXIL Global Design

- LIVING CULTURE