LIXIL makes pioneering water and housing products that solve everyday, real-life challenges, making better homes a reality for everyone, everywhere.

- Global Site

-

- English

- Japanese

- Brand Sites

Global

- Global Site

-

- English

- Japanese

- Brand Sites

As the Company is a company with a nomination committee, etc., the Compensation Committee (the “Committee”), composed solely of Outside Directors, determines compensation policy for Directors and Executive Officers received from the Company as consideration for their duties and the individual compensation for them.

Compensation basic policies for Directors and Executive Officers

The Compensation for Directors and Executive Officers shall be determined in accordance with the following basic policies.

(a) Foster improvement of short-, medium-, and long-term business results and sustainable corporate value.

(b) Attract and retain the best talent who are necessary to foster business growth globally.

(c) Determine compensation through a fair and reasonable decision-making process that will provide accountability to shareholders, employees, and all stakeholders.

(d) Consider and discuss compensation based on the economic and social situation, our business condition and objective indexes based on survey results conducted by external specialized agencies and advice of external specialized agencies at the Committee.

(e) Individual compensation shall be managed in consideration of role and responsibility, business

performance, experience and difficulty of securing personnel, etc.

Compensation System

The compensation structure for Directors who monitor and supervise the Company’s management, and for Executive Officers who are responsible for the performance of business, shall be separate. When a Director concurrently serves as an Executive Officer, the compensation system for the Executive Officers shall be applied.

■Directors’ Compensation system

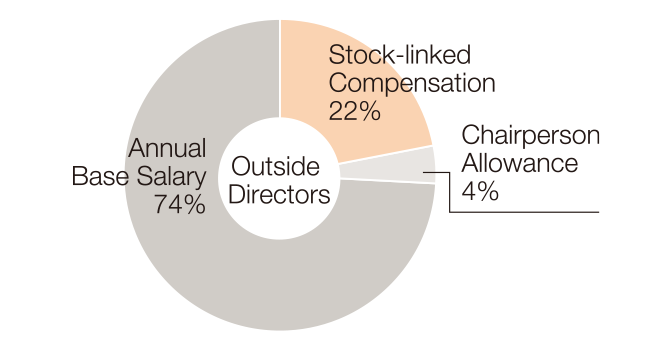

The compensation system for Directors consists of Annual Base Salary and Stock-linked compensation as they are required to act to contribute to increase the sustainable corporate value while they are monitoring and supervising the management during their statutory terms. In the event that an Outside Director assumes the role of chairperson of the Board of Directors or chairperson of a Committee, an allowance shall be paid for such duties (the “Chairperson Allowance”).

The above chart shows the compensation mix (median value) of Outside Directors for the Fiscal Year ended March 2024. Stock-linked compensation is indicated for a ratio based on the base amount.

■Executive Officers’ Compensation system

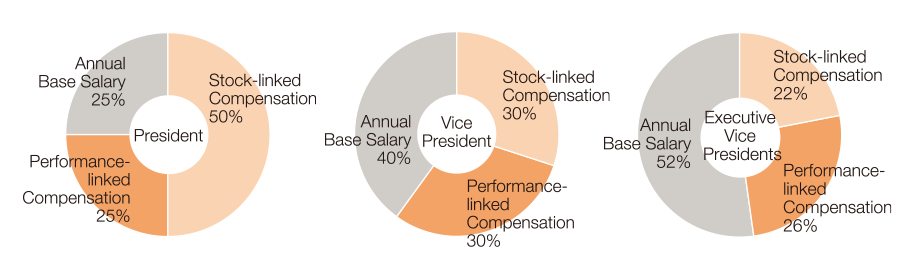

The compensation system for Executive Officers consists of Annual Base Salary, Performance-linked compensation and Stock-linked compensation, based on the policy of retaining talented human resources that are essential for accelerating business growth, rewarding Executive Officers fairly and equitably in accordance with their performance and properly reflecting the trust and evaluation of shareholders and other stakeholders in the compensation. Regarding the details of the individual compensation for Executive Officers, the Committee determines the compensation level and compensation mix based on the role and responsibility, business performance, experience and difficulty of securing personnel, etc. of each Executive Officer, as well as the performance targets and ESG action targets, etc. for each of them. In particular, for Executive Officers who are expected to contribute significantly to improving corporate value from a medium- to long-term perspective, the Committee takes measures such as increasing the ratio of Stock-linked compensation to total compensation.

The above chart shows the compensation mix for the Fiscal Year ended March 2024. The compensation for Executive Vice President is the median value. Performance-linked compensation and Stock-linked compensation are indicated for ratios based on the base amount.

Compensation system overview

【Annual Base Salary】

Annual Base Salary of Outside Directors shall be determined, based on the role of Outside Directors at the Company, while referring to the compensation levels of the upper group among domestic companies as reference information in line with the purpose of the compensation basic policies.

Annual Base Salary of Executive Officers shall be determined individually, based on role and responsibility, business performance, experience and difficulty of securing personnel, etc. of each Executive Officer, while referring to the compensation levels of domestic and foreign companies as reference information in line with the purpose of the compensation basic policies.

【Performance-linked compensation】

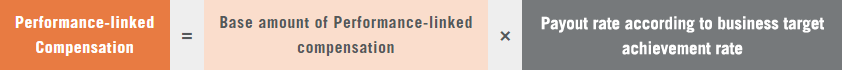

In order to encourage the Executive Officers to work together to achieve single-year management goals and to ensure that they are fairly equitably rewarded in accordance with the results of their performance, Performance-linked compensation is calculated based on only the company-wide performance targets used as a basis for calculating the payout rate.

- The base amount shall be determined individually by the Committee as a certain percentage of Annual Base Salary according to the role and responsibility, etc. of subject officers, based on the survey results conducted by external specialized agencies and a comparison of compensation levels with domestic and foreign companies of similar business scale in line with the purpose of the compensation basic policies.

- Business target achievement rate shall be set by calculating the ratio based on the actual figures disclosed in the Annual Securities Report versus the forecast figures disclosed in the flash reports or the like at the beginning of each period. If there is more than one business target, business target achievement rate is multiplied by the percentage of each target in the total performance target, and then aggregated.

- Business target items are return on invested capital (ROIC), core earnings, and net profit for the period belonging to the owners of the parent company (net income).

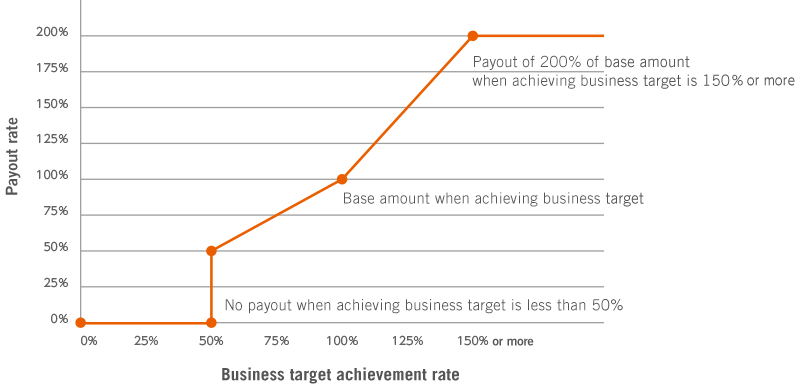

- The payout rate according to business target achievement rate is shown in the chart below.

【Stock-linked compensation】

The Company has been applying Stock-linked compensation in order to encourage Directors and Executive Officers to deepen their shared interests with shareholders and work to create corporate value over medium- to long-term. Stock-linked compensation consists of the Phantom Stock Plan, which is a stock-linked monetary compensation plan applied for Directors and Executive Officers from the Fiscal Year ended March 2020, and the Restricted Stock Compensation Plan, which is applied for Executive Officers form the Fiscal Year ended March 2024. The ratio of the Phantom Stock Plan and the Restricted Stock Compensation Plan for Executive Officers is, in principle, 50% for each.

【Stock-linked compensation I: Phantom Stock Plan】

The Phantom Stock Plan is a system for the compensation amount to increase or decrease in accordance with changes in the Company’s stock price.

- The Company grants the Phantom Stock to Directors on the day of each Annual Shareholders’ Meeting, and to Executive Officers on the first day of each Fiscal Year.

- The number of the Phantom Stock granted to each Director and Executive Officer shall be the number calculated by dividing the base amount, which is calculated by multiplies Annual Base Salary by the coefficient according to responsibilities, etc., of the eligible officer, by the Company’s stock price at the time of grant.

- After the period from the grant date to the vesting date (the “Holding Period”) has passed, the amount calculated by multiplying the stock price at that time by the number of stocks held shall be paid.

Note: The average of closing price of the Company's stock for the previous 30 business days is applied at both grant and vesting.

【Stock-linked compensation II: Restricted Stock Compensation Plan】

Executive Officers subject to this plan include Executive Officers who concurrently serve as Directors and exclude non-residents of Japan. For non-residents of Japan, the Phantom Stock Plan shall be applied.

- In principle, the Company allots shares to Executive Officers within two months of the first day of each Fiscal Year.

- The number of shares allotted to each Executive Officer shall be the number calculated by dividing the base amount, which is calculated by multiplies Annual Base Salary by the coefficient according to responsibilities, etc., of each Executive Officer, by the Company’s stock price at the time of allotment. The Company’s stock price at the time of allotment is, in principle, the average of closing price of the Company's stock for the 30 business days prior to the first day of the Fiscal Year.

- The transfer restriction period is from the allotment date until the person subject to the allotment leaves office from every position as Director or Executive Officer of the Company.

【Stock Ownership Guidelines】

The Company has established Stock Ownership Guidelines from the Fiscal Year ended March 2024, which indicate the number of the Company’s shares recommended to be held by Executive Officers during their term of office.

Representative Executive

Officers: Three times the amount of Annual Base Salary; other Executive Officers: One time the amount of

Annual Base Salary

【Malus and claw back provisions】

In Performance-linked compensation and Stock-linked compensation, if there has been any material accounting mistake with the Company or the Board of Directors determines that there has been a material violation, etc. by the officer concerned, the Committee may decide to reduce or extinguish pre-vested compensation and to return post-vested compensation based on such reasons.

Total amount of compensation of Directors and Executive Officers for the Fiscal Year ended March 2024

| Officer category | Total amount of compensation (million yen) |

Total amount of compensation by type (million yen) | Number of Officers receiving | ||||

|---|---|---|---|---|---|---|---|

| Annual Base Salary | Performance-linked compensation |

Stock-linked compensation |

Others | ||||

| Phantom Stock |

Restricted Stock |

||||||

| Outside Directors | 178 (178) |

144 (144) |

- | 34 (34) |

- | - | 10 |

| Executive Officers | 1,060 (955) |

621 (516) |

- | 213 (213) |

225 (225) |

1 (1) |

8 |

| Total | 1,238 (1,133) |

765 (660) |

- | 247 (247) |

225 (225) |

1 (1) |

18 |

Notes:

-

Amounts based on Japan standard.

-

The total amount of compensation shown above are stated as consolidated compensation, which are the total amount of compensation paid by the Company and the Company’s subsidiaries. The amount in parentheses is the total amount of compensation paid by the Company.

-

Regarding Performance-linked compensation and Stock-linked compensation, the amounts that should be recorded as expenses for the Fiscal Year ended March 2024 are stated.

-

The amount of Annual Base Salary for Outside Directors includes the Chairperson Allowance.

Compensation for the officers with total compensation of 100 million yen or more for the Fiscal Year ended March 2024

| Name | Officer category | Company name | Total amount of compensation (million yen) |

Total amount of compensation by type (million yen) | ||||

|---|---|---|---|---|---|---|---|---|

| Annual Base Salary | Performance-linked compensation |

Stock-linked compensation |

Others | |||||

| Phantom Stock | Restricted Stock | |||||||

| Kinya Seto | Executive Officer | LIXIL | 305 | 125 | - | 55 | 125 | - |

| Hwa Jin Song Montesano | Executive Officer | LIXIL | 183 | 113 | - | 30 | 40 | 0 |

| Bijoy Mohan | Executive Officer | LIXIL | 147 | 48 | - | 99 | - | - |

| Director | LIXIL International Pte. Ltd | 105 | 105 | - | - | - | - | |

Notes:

-

Amounts based on Japan standard.

-

Annual Base Salary is the amount paid as determined by the Compensation Committee.

-

Performance-linked compensation is the expensed amount calculated based on the base amount of Performance-linked compensation determined by the Compensation Committee with the business forecast as of March 31, 2024.

-

Stock-linked compensation is the expensed amount calculated based on the base amount of Phantom Stock and Restricted Stock determined by the Compensation Committee. Phantom Stock is not the actual amount paid but the expensed amount calculated based on the number of stocks granted as Phantom Stock for the three fiscal years from the Fiscal Year ended March 2022 to the Fiscal Year ended March 2024. The expensed amount is calculated by adding up the following three items.

1) The amount which is calculated by multiplying the number of stocks granted in the Fiscal Year ended March 2024 by the stock price at the end date of the Fiscal Year ended March 2024

2) The amount which is calculated by multiplying the number of stocks granted in the Fiscal Year ended March 2023 by the difference between the stock prices at the end date of the Fiscal Year ended March 2023 and the Fiscal Year ended March 2024 (The difference value is a positive value if the stock price goes up, and a negative value if it goes down.)

3) The amount which is calculated by multiplying the number of stocks granted in the Fiscal Year ended March 2022 by the difference between the stock prices at the end date of the Fiscal Year ended March 2023 and the time of vesting (The difference value is a positive value if the stock price goes up, and a negative value if it goes down.)

For details of the executive compensation, please refer to the "Report for the 82nd Fiscal Year".

Shareholders' Meeting >About Us

- About Us

- Our Purpose and Behaviors

- Value Creation Process

- Corporate Governance

- Our Brands

- Corporate Information

- Our History

- Group Companies

- Board & Executive Officers

- Kinya Seto

- Jin Song Montesano

- Jun Aoki

- Shigeki Ishizuka

- Ryusuke Ohori

- Shiho Konno

- Mayumi Tamura

- Yuji Nishiura

- Daisuke Hamaguchi

- Mariko Watahiki

- Yugo Kanazawa

- Bijoy Mohan

- Satoshi Yoshida

- Hiroyuki Oonishi

- Shoko Kimijima

- Mariko Fujita

- Reason for Nomination and Expected Role of Directors

- Reason for Election of Executive Officers

- External Evaluations & Awards

- LIXIL Global Design

- LIVING CULTURE