LIXIL makes pioneering water and housing products that solve everyday, real-life challenges, making better homes a reality for everyone, everywhere.

- Global Site

-

- English

- Japanese

- Brand Sites

Global

- Global Site

-

- English

- Japanese

- Brand Sites

This website contains information about business conditions, the financial situation, and other factors that may influence investor decisions. Forward-looking statements are based on the judgments of the LIXIL group of companies’ management as of March 2024.

Statements concerning the future and assumptions are subject to uncertainty and risks, and actual results may vary significantly.

Principal Risks and Countermeasures

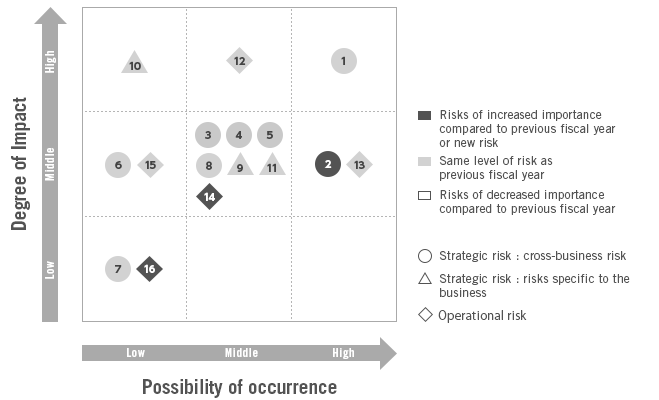

The group identifies risks that might impact its business activities and conducts annual group-wide risks assessments.Based on the assessment results, we then select risks that are important to us as a group. The results of the risk assessments and the list of material risks are reported by the head office Risk Management Department to the Risk Management Committee for resolution. The Committee places the risks in order of priority and monitors them.

These risks are classified into strategic risks and operational risks. Strategic risks are broadly scrutinized from a medium- to long-term perspective in terms of management policy, business strategy, and Impact Strategy, as well as from the perspective of our stakeholders. In the case of operational risks, risk owners are responsible for promoting measures to respond to these risks. The group strives to enhance the transparency of its risk management by disclosing information on material risks and countermeasures.

The possibility of occurrence and the degree of impact are residual; after taking into account the countermeasures.

Risks that could have a significant impact on the business in the long-term future (three to five years or later) are identified as emerging risks and countermeasures are being promoted.

| Business Risk | Possibility of Occurrence* | Degree of Impact | Changes in Materiality from the Previous Fiscal Year | ||

|---|---|---|---|---|---|

| Strategic Risk | (1) | Risks related to changes in the economic environment and fluctuations in exchange rates and interest rates | High | High | Same level |

| (2) | Geopolitical risks | High | Middle | Same level | |

| (3) | Risks related to the development of new products | Middle | Middle | Same level | |

| (4) | Risks related to the procurement of raw materials | Middle | Middle | Same level | |

| (5) | Risks related to environment (Climate change, water, and resources) | Middle | Middle | Same level | |

| (6) | Risks related to business restructuring | Low | Middle | Same level | |

| (7) | Risks related to competition with competitors and product prices | Middle | Middle | Same level | |

| (8) | Risks related to the acquisition and development of human resources and the promotion of diversity | Middle | Middle | Same level | |

| (9) | Risks related to sales channels | Middle | Middle | Same level | |

| (10) | Brand risks | Low | High | Same level | |

| Operational Risk | (11) | Risks related to disasters, accidents and infectious diseases | Middle | High | Same level |

| (12) | Risks related to information and cyber security | High | Middle | Same level | |

| (13) | Risks related to intellectual property | Middle | Middle | Same level | |

| (14) | Recoverability risk of deferred tax assets | Middle (Low) | Middle | Increase | |

| (15) | Risks related to regulatory environment and requirements | Low | Low | Same level | |

* For risks that the assessments have been changed from the previous consolidated fiscal year,

the previous year's risk assessments are included in ( ).

For details of the LIXIL group's strategic, operational, and emerging risks and countermeasures, please refer to the PDF.